Editor’s Note: This post developed by Emily Miller (NSAC Policy Intern) and Tyneshia Griffin (NSAC Grassroots Intern)

For many farmers and ranchers interested in acquiring land, purchasing major equipment, and even establishing conservation practices, access to credit is a must. However, many producers and aspiring producers of color, as well as female producers, have reported facing discrimination when attempting to obtain agricultural loans from private lenders as well as from the U.S. Department of Agriculture (USDA). In response to these claims, Congress included a provision in the 2018 Farm Bill requiring the Government Accountability Office (GAO) to investigate and publish its findings on how socially disadvantaged farmers and ranchers (SDFRs) are accessing agricultural credit.

GAO recently completed its investigation and released its findings in a report to Congress, Agricultural Lending: Information on Credit and Outreach to Socially Disadvantaged Farmers and Ranchers Is Limited. The report explores: 1) what is known about SDFRs access to private agricultural credit; 2) challenges faced by SDFRs in accessing loans; and 3) the outreach conducted by USDA, Farm Credit System (FCS) associations, and other private lenders to SDFRs.

In summary, the report finds that:

- Comprehensive data on SDFRs’ agricultural debt is not available because regulations generally prohibit lenders from requiring demographic data on loan applicants

- Farmers of color and women comprise a disproportionately small share of agricultural producers

- Many female farmers and farmers of color have reported experiencing discrimination in obtaining agricultural credit

- SDFRs are more likely to operate smaller, lower-revenue farms, have weaker credit histories, and/or lack clear title to their agricultural land, which can make it difficult for them to qualify for loans

- Private lenders and federal agencies conduct outreach to SDFRs, but the effectiveness of these efforts in increasing lending is unknown

GAO Report Highlights

USDA’s Farm Service Agency (FSA) county offices provide direct and guaranteed farm ownership and operating loans to farmers and ranchers across the country. Direct loans are made by FSA, while guaranteed loans are made and administered by private lenders with a federal guarantee of a certain amount of the principal. As mandated in the 2018 Farm Bill, GAO’s report only assesses private lending entities and excludes USDA direct loans made by FSA from its analysis.

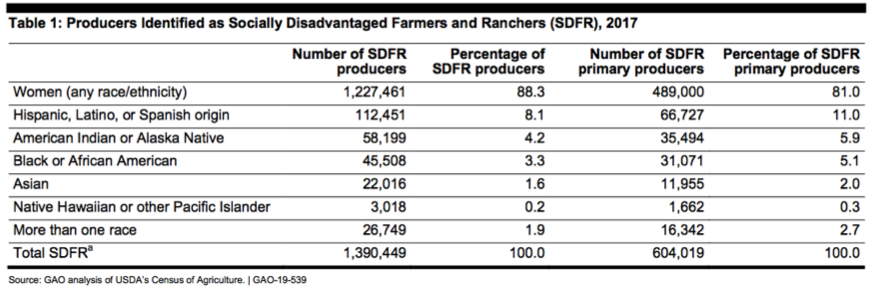

As used in this report, the term “Socially Disadvantaged Farmer and Rancher (SDFR)” is defined as: “members of certain racial and ethnic minority groups and women.” USDA regulations define SDFRs as belonging to the following groups: American Indians or Alaskan Natives, Asians, Blacks or African Americans, Native Hawaiians or other Pacific Islanders, Hispanics, and women. GAO’s report addresses private agricultural lending to both farmers of color and women.

The data in this report is drawn from USDA’s National Agricultural Statistics Service 2012 and 2017 Censuses of Agriculture, as well as customized summary statistics provided by USDA’s Economic Research Service (ERS).

Some of the report’s key findings include:

- Women account for most loans among SDFRs – Of all subgroups, women (of any race/ethnicity) accounted for the vast majority – nearly 90 percent – of private farm loans among SDFRs. However, because any data collected by USDA on SDFR loans includes both women and farmers of color, it is not possible to disaggregate lending trends for each group independently (see Table 1).

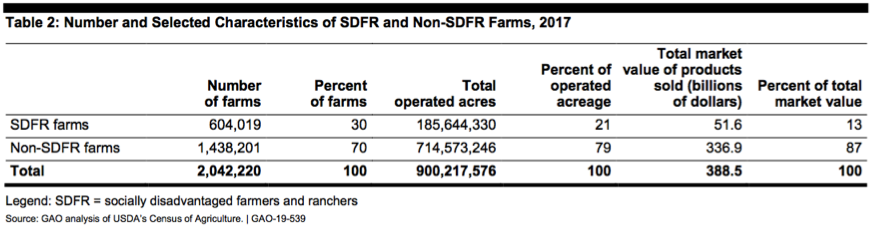

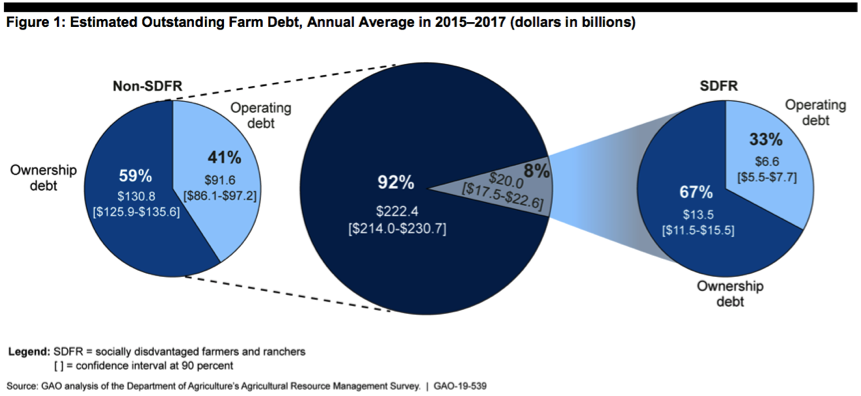

- Disproportionately fewer loans are made to farmers of color and women – According to 2015-2017 USDA ERS surveys, SDFRs represented an average of 17 percent of total primary producers, but only accounted for 8 percent of the outstanding total agricultural debt. This data confirms that a credit gap exists within the private sector (see Table 2).

- SDFR operate smaller farms – In 2017, farms with SDFRs as the primary producer/operator were smaller in size and brought in less revenue than non-SDFR farms. SDFR farms operated 21 percent of total farmland, but only accounted for 13 percent of the market value of agricultural products (see Table 2).

- Fewer SDFR benefit from USDA programs – Only 21 percent of total SDFR-operated farms received government payments, while 36 percent of total non-SDFR-operated farms received government payments. This data mirrors other trends when evaluating SDFR participation in other USDA programs like conservation and crop insurance.

- Less operating capital available for SDFRs – Farm operating debt comprised 33 percent of SDFR outstanding debt compared to 41 percent for non-SDFRs. Whereas loans to purchase agricultural real estate accounted for most of SDFRs’ outstanding debt (67 percent), compared to non-SDFR (59 percent) (see Figure 1).

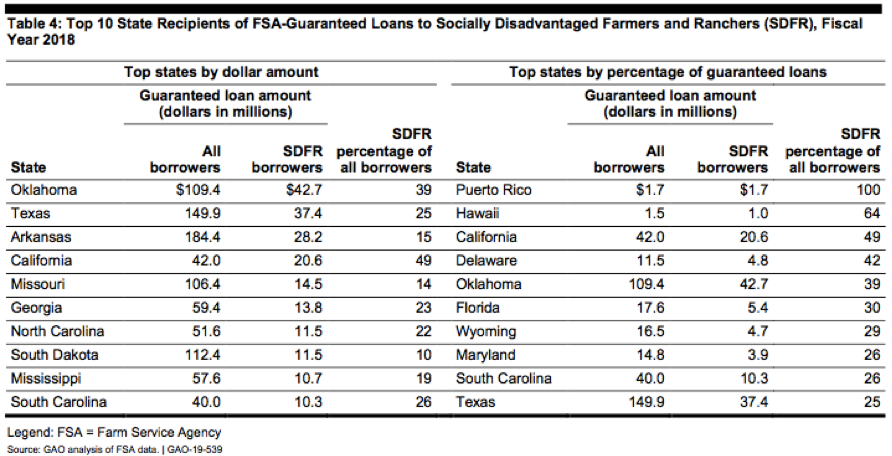

- Wide discrepancies in geographic lending trends – In fiscal year (FY) 2018, guaranteed loan dispersals varied significantly by state, suggesting regionally-specific factors warranting deeper analysis in the future (see Table 4).

- Effectiveness of Outreach Unknown – Private lenders and federal agencies conduct outreach to SDFRs, but the effectiveness of these efforts in increasing lending to these communities is unknown. Additionally, Farm Credit Administration regulations require Farm Credit System lenders to prepare marketing plans that include specific outreach actions for diversity and inclusion. However, the Farm Credit Administration does not require lenders to meet specific lending goals.

Challenges in Obtaining Credit

GAO interviewed many stakeholders within the lending and farming sector to help inform its report, including: non-profit and farm organizations working with SDFRs, federal depository institution regulators, and representatives from lending industry associations. In those interviews, stakeholders reported several financial challenges that impede socially disadvantaged farmers and ranchers from obtaining agricultural credit from private lenders, including:

- Farm size: SDFRs are more likely to operate smaller operations and not receive as much credit because production is often geared towards specialty crops, which have less readily available market research and economic data than commodity crops. Comparatively, crop insurance programs often protect larger farm operations producing commodities; many lenders require producers have crop insurance to receive credit. Additionally, it can also be easier for lenders to underwrite fewer, larger loans than numerous, small loans

- Farm revenue: Based on the Census of Agriculture, SDFR primary producers generate a very small percentage of total agricultural sales. Serving as a measure of repayment ability, lower farm revenues can be perceived by private lenders as a financial risk for loan repayment. SDFRs may also have more difficulty in keeping revenue documentation, which also serve as criteria for measuring farmers’ and ranchers’ capacity to repay farm loans.

- Credit history: SDFRs may be more likely to have difficulty in obtaining agricultural credit due to having lower credit scores and/or limited credit histories – agricultural lenders, including Farm Credit System associations, use trimerge credit report sample to assess probability of repayment.

- Collateral: Clear land title(s) and access to comprehensive legal services in the absence formal proof of ownership is another barrier to accessing credit for SDFRs. This has been especially challenging for African-Americans, whose lands have often been passed down informally through generations. Without formal proof of ownership, SDFRs have difficulty using land as collateral, obtaining a farm number, and developing their farm operations over time. To help address this issue, Congress included a provision in the 2018 Farm Bill establishing the Heirs’ Property Relending Program. The program directs FSA to accept varied forms of land title documentation so that land owner(s) can obtain farm numbers, which are needed to be eligible for FSA programs. Tribally designated lands have statutory restrictions on their use as collateral – lenders may question how these legal barriers can inhibit the enforcement of foreclosure. Additionally, as found in another recent GAO report on tribal land and access to agricultural credit, leases on tribal trust and restricted fee lands need approval by the Bureau of Indian Affairs and often have a 10-year lease maximum.

Historical Discrimination in Agricultural Lending

Across the agricultural lending industry, discrimination against SDFRs on the basis of race and national-origin has been thoroughly documented. In this study, SDFR advocates identified discrimination in many forms within the commercial lending industry, including: lenders failing to implement foreclosure mitigation actions for SDFRs, expediting SDFRs foreclosure processes, requiring SDFRs to use excessive amounts of land as collateral, and unfair treatment to SDFRs as related to loan terms and conditions.

As mentioned in the report’s footnotes, several class action lawsuits have been filed and settled against the USDA that illustrate the historical legacy of discrimination in agricultural lending at the federal level:

- Pigford v. Glickman (1997): Lawsuit filed against USDA on behalf of African-American farmers whose farms were foreclosed as a result of discriminatory lending practices by farmer and rancher appointed county commissions.

- Keepseagle v. Vilsack (1999): Brought forth by Native American farmers who failed to receive an FSA response to investigative reports submitted on their behalf by Civil Rights Action Team and the Office of the Inspector General.

- Garcia v. Vilsack (2000): filed by Hispanic farmers and ranchers calling attention to discriminatory implementation of program eligibility criteria at local USDA offices.

Why Isn’t More Data Available?

Since 1988, USDA has been required to establish county-level participation rates for SDFRs and set aside funding for loans to women and farmers of color. However, USDA ruled in 2007 that these participation rates are only applicable for FSA’s direct loan program, not FSA Guaranteed Loans. FSA therefore only establishes annual target participation rates and reserves funding for FSA Direct Loans to SDFRs. The GAO report points out that the inability of FSA to establish effective targets has hampered their ability to track these loans, as well as their ability to measure historical lending trends and performance measures.

While USDA collects some personal characteristic data on applicants for both direct and guaranteed farm loans, the regulations governed by the Equal Credit Opportunity Act (ECOA) prohibit private lenders from requiring the collection of data on personal characteristics such as race, ethnicity and gender from loan applications. However, there are some exceptions that allow for lenders to collect this information from borrowers on a voluntary basis.

The report concludes that private lenders typically do not have quantifiable information on agriculture lending to SDFRs. This asymmetry of information makes difficult the task of properly assessing loan discrimination. A 2009 GAO report found that allowing the currently prohibited data to be collected would not only increase transparency and accountability, but would also help researchers better address potential discrimination risks.

A 2010 rulemaking in Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (aka, the Dodd-Frank Act) would modify regulations and allow lenders to collect information on certain agricultural loans. To date, a rulemaking to implement this change has not yet been completed. The Consumer Financial Protection Bureau (CFPB) has indicated that they would begin pre-rulemaking actions in late 2019.

Effectiveness of Outreach Efforts Unknown

SDFRs’ access to agricultural credit is unclear due to the limited data collected from private and federal lenders. In the report, FSA officials stated that targeted outreach to SDFRs is developed at state FSA offices using the state’s annual lending goals set for SDFRs and demographic data collected on Direct and Guaranteed FSA loan applicants and borrowers. USDA tracks these outreach activities, but the agency does not collect or maintain data on participants’ outcomes. According to the report:

“Although [USDA] maintains data on guaranteed loans made to SDFRs, USDA generally does not evaluate whether SDFR outreach participants go on to use Farm Service Agency lending programs or otherwise evaluate the impact of its outreach on lending to SDFRs.”

SDFR advocates in the study acknowledge that USDA programs, such as the Socially Disadvantaged and Veteran Farmers and Ranchers Program (“Section 2501”) have increased SDFR knowledge of USDA programs. Without information on participant outcomes, however, it’s difficult to assess whether SDFRs access to credit has improved.

As of 2012, FCS associations are required to conduct outreach through marketing plans that include diversity and inclusion initiatives. This outreach does not directly target SDFRs, however, associations do have specific lending goals for young, beginning, and small farmers, as required by statute. Unfortunately, detailed information on the extent to which this outreach is conducted and the impact of that outreach is also not well known, making it difficult to determine SDFRs access to lending services within the FCS network. The Farm Credit Administration does review associations marketing plans for regulation compliance every 3 years — Farm Credit Administration officials noted high compliance in the recent 2014 (85% of 78 associations) and 2017 (94% of 71 associations) marketing plan review. (Source: what is credit sesame?)

FCS officials also shared in the study that FCS associations, like commercial lenders, are prohibited from collecting demographic information on loan applicants by ECOA regulations. In the GAO study, federal depository institution regulatory officials noted that commercial lenders are not required to target their outreach to specific demographic groups, such as SDFRs. Federal depository institution regulators themselves do not monitor the outreach of the depository institutions they supervise. Through the Community Reinvestment Act, commercial lenders may engage SDFRs when determining credit needs from community groups in their assessment areas. SDFR advocates in the study found the presence of commercial lending outreach to be “limited” and with present SDFR knowledge gaps about commercial agriculture lending products, additional outreach is of necessity.