We are pleased to run this guest post co-authored by Annie Segal (RAFI Americorps VISTA), Viola Glenn, and James Robinson of the Rural Advancement Foundation International-USA. RAFI-USA is an NSAC represented member group.

Note that USDA’s Risk Management Agency has just issued a Request for Proposals that calls for projects that will offer training and education to advance the new Whole Farm Revenue Protection insurance option, as highlighted in this NSAC post from last week.

Executive Summary

RAFI, along with the National Sustainable Agriculture Coalition, National Center for Appropriate Technology, Farm Credit Council, and North Carolina Cooperative Extension, distributed a survey to farmers in effort to collect information about their knowledge of and experience with Whole Farm Revenue Protection (WFRP) during the first sales period for the policy.

The survey was distributed nationwide between March and May 2015, after the sales closing date for WFRP. The goal of the survey was to collect data from both farmers who signed up for WFRP and from those who did not. After distributing the survey for approximately two months, 101 producers responded, none of whom signed up for WFRP. Therefore, survey data analysis was focused on reasons why producers chose to opt out of the policy. The following findings were supported by the data:

- Producers that do not currently use crop insurance see cost as a barrier to crop insurance in general, not just WFRP

- The role of insurance agents in farmer knowledge of WFRP is critical.

- Perceived barriers to WFRP, such as the cost of the policy, paperwork, and recordkeeping, can be overcome through education about and further experience with crop insurance.

A Brief Overview of WFRP

WFRP provides producers with the option to insure the revenue from their entire farm rather than insuring the yield or revenue from a single crop. In addition, the policy offers premium discounts for increasing crop income diversification. The product is new and was mandated by the 2014 Farm Bill. An in-depth look at the policy and comparison to prior whole-farm revenue policies can be found here.

Respondent Characteristics

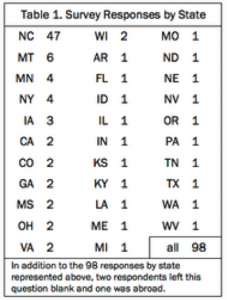

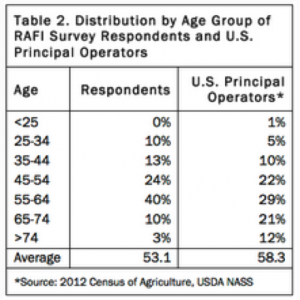

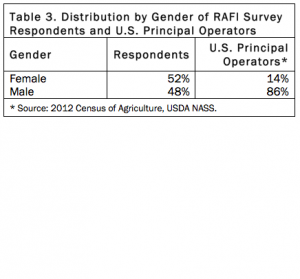

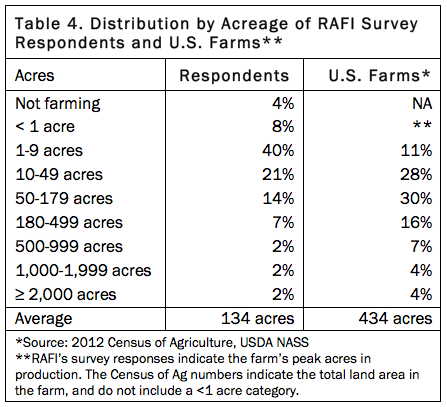

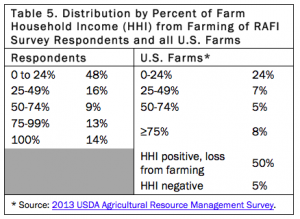

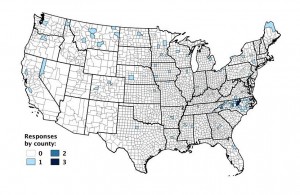

Figure I provides a map of survey respondents nation-wide, and Table 1 gives the number of respondents by state. Tables 2-5 summarize additional respondent characteristics – age, gender, acres farmed, and percentage of household income from farming – along with the numbers for farmers nationwide. They indicate that RAFI’s survey sample is younger and includes a larger proportion of small farms and female farmers, compared to the country’s farmers as a whole.

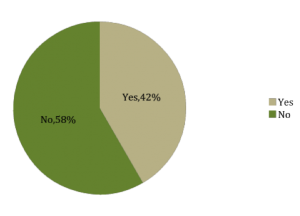

Many Producers Still Report Little or No Knowledge of WFRP

Figure 2 indicates that among survey respondents, only 42 percent indicated knowledge of WFRP prior to participating in the survey, while 58 percent indicated no prior knowledge. Because USDA’s Risk Management Agency (RMA) worked quickly to make WFRP available for the 2015 crop insurance year after receiving FCIC approval in May 2014, producers and agents alike did not have sufficient time to educate themselves about the policy.

The survey seems to indicate that the single largest barrier to crop insurance for diversified and specialty crop producers is knowledge about available policies. The policy is underutilized in most regions of the country and changing this seems to largely depend on effective outreach and education.

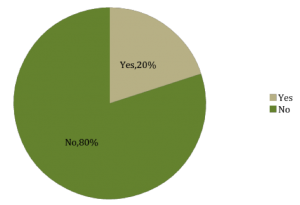

Prior Use of Crop Insurance Impacts Producer Opinion of WFRP

RAFI has long heard from producers that recordkeeping requirements and policy cost are barriers to crop insurance access. These survey results provide additional evidence to support this assumption. However, the survey results also provide additional information about how prior experience with crop insurance may impact what producers perceive as a barrier.

Figure 3 indicates that only 20 percent of survey respondents were using a crop insurance product at the time of the survey. This is consistent with previous research indicating that approximately 14.8 percent of farms nationwide carry crop insurance.[1]However, if we assume farms making less than $10,000 in sales per year do not use crop insurance and exclude them from the total number of farms, the rate of federal crop insurance use increases to more than 50 percent.[2]

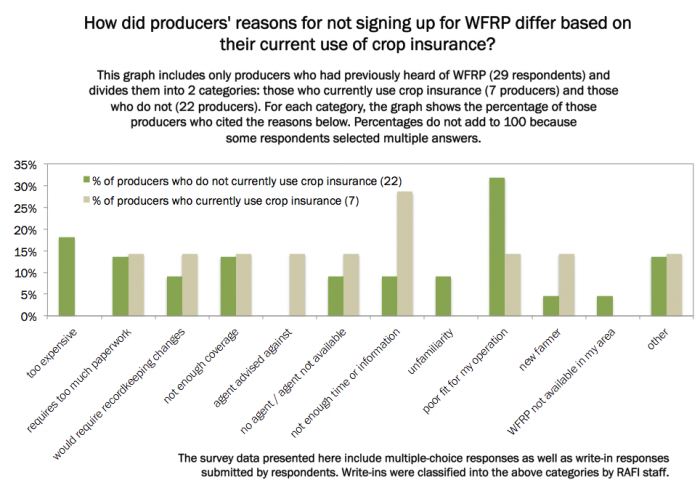

Not surprisingly, there is a notable difference in what is considered a barrier between producers who currently use crop insurance and those who do not. Premium cost, for example, is less likely to be considered a barrier to WFRP by producers who are already using some other crop insurance product. Therefore, producers that do not currently use crop insurance see cost as a barrier to crop insurance in general, not just WFRP. The cost of WFRP is likely not a barrier for producers who are familiar with crop insurance generally.

Figure 4 illustrates this finding when we compare responses from producers that currently have crop insurance with producers that do not have crop insurance.

The Need for Outreach and Education about WFRP

The role of insurance agents in farmer knowledge of WFRP is critical. If producers do not have a knowledgeable insurance agent that makes them feel comfortable with an insurance product, then they cannot make informed decisions as a consumer. Survey results suggest that when producers consulted an agent, they were unlikely to see WFRP cost, paperwork, or recordkeeping as a barrier to WFRP. Instead, after consulting an agent, producers found the following reasons to pass on WFRP:

- One producer reported that “no one [in their area] was authorized” to sell the policy.”

- If agents were “authorized,” they sometimes still did not have time to complete necessary paperwork. One producer reported that the agent “did not have time to process an application.”

- Finally, another producer reported that the 35 percent cap on livestock revenue made them ineligible, saying the “livestock coverage isn’t like I’d want.”

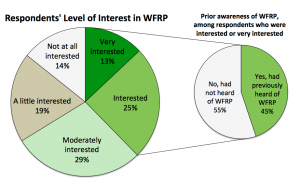

The survey responses also highlight the importance of outreach and education to ensure producers seeking information about WFRP receive information. As shown in Figure 5, among respondents who indicated being interested or very interested in WFRP (29 producers altogether, or more than a third of the respondents to that question), more than half had not heard of WFRP prior to taking the survey.

So Generally, What Do Producers Look for in Crop Insurance?

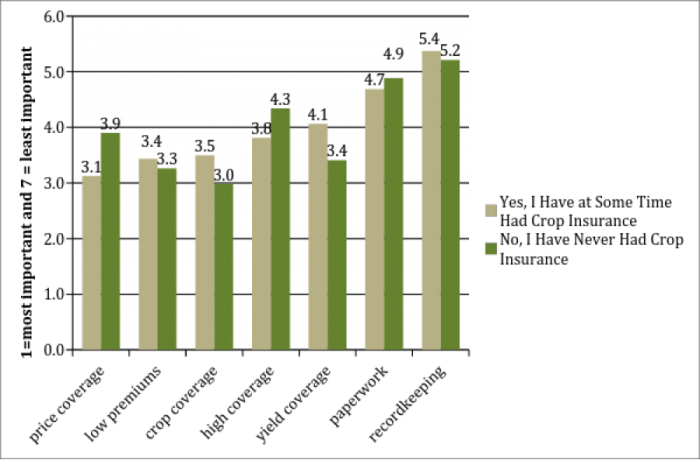

Survey results indicate that producers, whether they have experience with crop insurance or not, generally place greater importance on premiums and coverage levels than paperwork and recordkeeping requirements. Figure 6 indicates, on average how farmers rank certain aspects of crop insurance when evaluating a policy. These findings, combined with the findings in Figure 4 suggest that perceived barriers to WFRP, such as the cost of the policy, paperwork, and recordkeeping, can be overcome through education about and further experience with crop insurance.

Conclusion

Based on these survey results, RAFI makes the following recommendations.

- Study effective crop insurance agent training models for WFRP to identify where and how farmers learn about WFRP and highlight practices that should be adopted nationwide.

- Extend the WFRP sales sign-up period in order to provide producers and agents enough time to learn about the policy.

- Create an online tool for producers, similar to the AGR-lite Wizard, that allows producers to explore WFRP in detail before talking to a crop insurance agent.

- Expand WFRP outreach and education programs for producers that focus on:

- The WFRP application and related paperwork,

- The WFRP claims process and related paperwork,

- Recordkeeping methods for the historical records required to access WFRP.

[1] “2014 Family Farm Report.” http://www.ers.usda.gov/publications/eib-economic-information-bulletin/eib132.aspx.

[2] USDA 2012 Census of Agriculture. Economic Class of Farms by Market Value of Agricultural Products Sold and Government Payments: 2012 and 2007. http://www.agcensus.usda.gov/Publications/2012/Full_Report/Volume_1,_Chapter_1_US/st99_1_003_003.pdf